Getting a startup business loan with no money seems impossible. But there are ways to make it happen.

Starting a business with little to no money is a common challenge for many entrepreneurs. Traditional lenders often require collateral or a substantial down payment. But don’t lose hope. There are alternative funding options available that can help you secure a loan for your startup.

With the right approach and knowledge, you can find lenders willing to support your business idea. This guide will explore various strategies and tips to help you get that much-needed startup loan, even if you have no money upfront. Ready to learn how? Let’s dive in!

Startup Business Loans

Starting a new business often requires financial support. Many entrepreneurs wonder how to get a startup business loan with no money. Fortunately, various startup business loans can help you get your venture off the ground. This guide will explore different types of loans and the eligibility criteria you need to meet.

Types Of Loans

Several types of loans are available for startups. Each one has unique features that cater to different business needs. Understanding these options can help you choose the best one for your startup.

- Unsecured Business Loans: These loans do not require collateral. They are ideal for startups with no assets to pledge.

- Microloans For Startups: Small loans usually provided by non-profit organizations. These loans are perfect for covering minor expenses.

- No-Collateral Loans: Similar to unsecured loans. These loans do not need any property or asset as security.

- Small Business Grants: Free money provided by the government or private organizations. Unlike loans, you do not need to repay grants.

- Venture Capital For Startups: Investors provide capital in exchange for equity in the company. This option is suitable for startups with high growth potential.

| Loan Type | Features | Best For |

|---|---|---|

| Unsecured Business Loans | No collateral needed, quick approval | Startups with no assets |

| Microloans For Startups | Small loan amounts, non-profit lenders | Covering minor expenses |

| No-Collateral Loans | No property required, flexible terms | New businesses with limited assets |

| Small Business Grants | No repayment needed, competitive application | Businesses with a social impact |

| Venture Capital For Startups | Equity exchange, potential for large funds | High-growth potential startups |

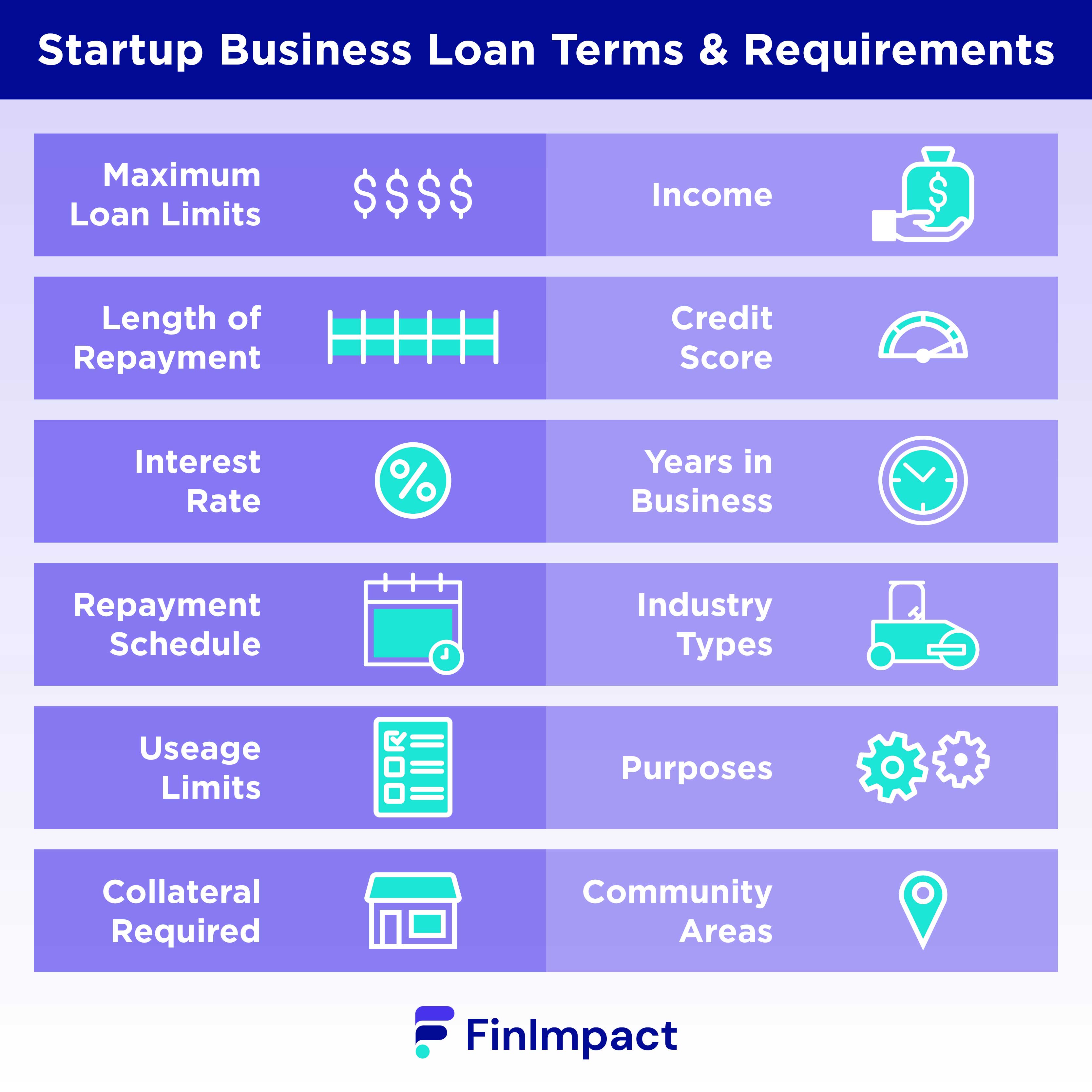

Eligibility Criteria

Eligibility criteria for startup business loans vary based on the type of loan. It’s essential to understand these requirements to improve your chances of approval.

- Business Plan For Loan Application: A solid business plan is crucial. It should outline your business model, target market, and financial projections.

- Credit Score Impact: Your credit score plays a significant role. A higher score increases your chances of getting approved.

- Business Loan Requirements: Different lenders have specific requirements. These can include your business age, revenue, and financial statements.

- Alternative Financing Solutions: If traditional loans are not an option, consider alternative financing. Options like crowdfunding or peer-to-peer lending can be viable alternatives.

Meeting these criteria will help you secure a loan:

- Create a detailed business plan.

- Ensure your credit score is in good shape.

- Gather necessary financial documents.

- Explore alternative financing solutions if needed.

Each lender might have additional requirements. Check with them to ensure you meet all necessary criteria.

Creating A Business Plan

Starting a new business often requires securing funding, but what happens if you have no money? Creating a business plan is a critical step in obtaining a startup business loan. A well-crafted business plan can demonstrate to lenders that your business idea is viable and that you have a strategy for success. Let’s explore the essential components and financial projections needed to make your business plan compelling.

Essential Components

A strong business plan includes several key elements. These components give lenders a clear picture of your business, its goals, and how you plan to achieve them. Here are the essential components to include:

- Executive Summary: A brief overview of your business idea, including the mission statement, product or service, and basic information about the leadership team.

- Company Description: Detailed information about your business, including its structure, target market, and the problem it solves.

- Market Analysis: Research on your industry, market size, expected growth, and your position within the market. Highlight your competitive advantage.

- Organization and Management: An outline of your business’s organizational structure, detailing the management team and their roles.

- Products or Services: A description of what you’re selling or the service you provide. Explain the benefits and how it meets the market’s needs.

- Marketing and Sales Strategy: An overview of how you plan to attract and retain customers. Include sales tactics, advertising plans, and pricing strategy.

- Funding Request: Specify the amount of money you need to start and run your business. Explain how you will use the funds.

Including these components in your business plan will help address the startup loan requirements and increase your chances of securing financing. A detailed business plan shows lenders that you understand your market and have a clear strategy for success.

Financial Projections

Financial projections are a crucial part of your business plan. They provide a forecast of your business’s financial performance. These projections help demonstrate the potential profitability of your venture. Here are the critical elements to include:

- Income Statement: Also known as a profit and loss statement. This shows your revenue, costs, and profits over a specific period. It helps lenders see how your business will make money.

- Cash Flow Statement: This details the inflows and outflows of cash. It shows how much cash is available to run the business. This is vital for demonstrating your ability to manage finances.

- Balance Sheet: A snapshot of your business’s financial situation at a specific point in time. It includes assets, liabilities, and equity. This helps in assessing the financial health of your business.

- Break-Even Analysis: This shows when your business will be able to cover its expenses and start making a profit. It is a critical piece for lenders to understand the risk involved.

Here is a simplified table to illustrate your financial projections:

| Year | Revenue | Expenses | Net Profit |

|---|---|---|---|

| 1 | $100,000 | $80,000 | $20,000 |

| 2 | $150,000 | $100,000 | $50,000 |

| 3 | $200,000 | $120,000 | $80,000 |

Having detailed financial projections will make your business plan more robust. It shows lenders that you have a clear financial strategy and understand the economics of your business. This can be particularly important when seeking unsecured business loans, no collateral business loans, or alternative lending sources.

Building Your Credit

Starting a business without money can be challenging. Getting a startup business loan with no money is possible, but it requires building your credit. Establishing a strong credit profile is essential for loan eligibility. Financial institutions will look at your credit history to determine your reliability. Let’s explore how you can build your credit to increase your chances of securing startup financing.

Checking Your Credit Score

Your credit score is a key factor in getting a loan. Start by checking your credit score from major credit bureaus. You can get a free annual credit report from each bureau. Here’s how to do it:

- Visit Annual Credit Report

- Request your reports from Equifax, Experian, and TransUnion

- Review your credit reports for accuracy

Understanding your credit score helps you know where you stand. Scores range from 300 to 850. Higher scores indicate better creditworthiness. A score above 700 is considered good. Here’s a quick reference:

| Credit Score Range | Rating |

|---|---|

| 300-579 | Poor |

| 580-669 | Fair |

| 670-739 | Good |

| 740-799 | Very Good |

| 800-850 | Excellent |

If your score is low, don’t worry. Improving your score is possible. Financial institutions consider your credit history when determining loan eligibility. Building a strong credit profile is the next step.

Improving Your Score

Improving your credit score takes time and effort. Start by paying your bills on time. Late payments can negatively impact your score. Here are some tips:

- Pay off outstanding debts

- Keep credit card balances low

- Do not apply for new credit frequently

- Dispute any inaccuracies on your credit report

Using a secured credit card can help build your credit. This type of card requires a cash deposit, which serves as your credit limit. Responsible use of a secured card can improve your credit score over time.

Consider alternative funding options like Small Business Grants or Crowdfunding For Startups. These options do not rely solely on your credit score. A solid Business Plan Requirements and a compelling pitch can attract investors.

Unsecured Business Loans and Personal Loans For Startups are also options. These loans do not require collateral. However, a good credit score is essential for approval. Improving your credit score will increase your chances of securing these loans.

Financial institutions also look at your Business Credit Score. Building business credit is separate from personal credit. Ensure you register your business with a business credit bureau. Pay your business bills on time and manage your business debts responsibly.

By following these steps, you can improve your credit score and increase your chances of getting a startup business loan with no money. Stay focused and patient, and you will be on your way to achieving your business goals.

Alternative Funding Options

Starting a business with no money can be a daunting task. Traditional loans often require collateral or good credit scores, which many new entrepreneurs lack. Fortunately, there are alternative funding options available to help you get your startup off the ground. These methods can provide the necessary capital without the need for significant upfront investment. Two popular options are crowdfunding and seeking angel investors.

Crowdfunding

Crowdfunding has become a popular way to raise money for startups. This method involves asking a large number of people to contribute small amounts of money to your business idea. Platforms like Kickstarter and Indiegogo have made it easier than ever to reach a broad audience.

Here are some key benefits of crowdfunding:

- Access to a large pool of investors: You can reach a wide audience willing to invest small amounts.

- Market validation: A successful campaign proves there is a demand for your product or service.

- No need for collateral: Most crowdfunding platforms do not require you to pledge assets.

To create a successful crowdfunding campaign, consider these tips:

- Tell a compelling story: Explain why your business matters and how it will make a difference.

- Offer attractive rewards: Incentives can motivate people to back your project.

- Engage with your audience: Respond to questions and provide updates regularly.

Below is a comparison table of popular crowdfunding platforms:

| Platform | Funding Model | Fees | Success Rate |

|---|---|---|---|

| Kickstarter | All-or-nothing | 5% | 37% |

| Indiegogo | Flexible | 5% | 9% |

| GoFundMe | Keep-what-you-raise | 0% | Varies |

Angel Investors

Angel investors are wealthy individuals who provide capital for startups in exchange for equity. They are often experienced entrepreneurs or executives who can offer valuable advice and mentorship in addition to funding.

Here are some advantages of partnering with angel investors:

- Significant funding: Angels can provide substantial amounts of money.

- Expertise and network: They bring experience and connections that can benefit your business.

- Flexible terms: Angels may offer more favorable terms than traditional lenders.

To attract angel investors, follow these steps:

- Develop a solid business plan: Show potential for growth and profitability.

- Network extensively: Attend events and join groups where angels are active.

- Prepare a compelling pitch: Clearly articulate your vision and financial needs.

Below is a comparison table of angel investment networks:

| Network | Typical Investment | Industries | Location |

|---|---|---|---|

| AngelList | $50,000 – $500,000 | Tech, Healthcare | Global |

| Keiretsu Forum | $100,000 – $1,000,000 | Various | Global |

| Golden Seeds | $50,000 – $500,000 | Women-led businesses | USA |

Microloans Explained

Starting a business without any money can seem impossible. Many entrepreneurs face this challenge. One option to consider is microloans. These small loans can help get your startup off the ground. Microloans explained will provide you with the knowledge you need to pursue this form of funding.

What Are Microloans?

Microloans are small loans designed to help entrepreneurs start or grow their businesses. These loans typically range from $500 to $50,000. They are perfect for those who need a smaller amount of money and may not qualify for traditional loans.

Microloans offer several benefits:

- Low-Interest Business Loans: Often, microloans come with lower interest rates.

- Unsecured Business Loans: Many microloans do not require collateral.

- Flexible Terms: Loan terms can be more flexible compared to traditional loans.

Here is a table comparing microloans to traditional loans:

| Loan Type | Loan Amount | Collateral Required | Interest Rate |

|---|---|---|---|

| Microloan | $500 – $50,000 | No | Lower |

| Traditional Loan | $50,000+ | Yes | Higher |

Microloans are part of alternative financing options. They provide financial assistance for startups and business loans for startups. If you have a solid business plan, microloans can be a great option. They offer a way to get the funds you need without large debt.

Where To Find Them

Finding microloans can be easier than you think. Many organizations offer these loans to help new businesses.

Here are some places to look:

- Small Business Administration (SBA): The SBA offers microloans through its partners. These loans are available to startups and small businesses.

- Nonprofit Organizations: Many nonprofits provide microloans for entrepreneurs. They focus on helping underserved communities.

- Community Development Financial Institutions (CDFIs): CDFIs offer loans to businesses in low-income communities. They aim to promote economic growth.

Crowdfunding for startups is another option. Platforms like Kickstarter or Indiegogo allow you to raise funds from many people. This can be a great way to get startup funding without taking on debt.

Here are some common microloan providers:

| Provider | Loan Amount | Interest Rate |

|---|---|---|

| Kiva | Up to $15,000 | 0% |

| Accion | $300 – $100,000 | Varies |

| Grameen America | Up to $2,000 | 15% |

These sources provide no-collateral business loans and can be crucial for your startup. Research each option to find the best fit for your needs. Microloans can be the stepping stone to your business success.

Grants For Startups

Starting a business without money can be challenging. One way to get funding is through grants. Grants for startups provide crucial financial assistance without the need to repay. This makes them an attractive option for new entrepreneurs. Unlike loans, grants do not require a good business credit score. They are a form of free money, often offered by governments, non-profits, and private organizations to support small businesses and encourage innovation.

Types Of Grants

Understanding the different types of grants available is vital for entrepreneurs. Here are some common types of small business grants:

- Government Grants: These are provided by federal, state, or local governments. They often focus on specific industries like technology or healthcare.

- Corporate Grants: Large corporations sometimes offer grants to support small businesses, especially in their supply chain or industry.

- Non-Profit Grants: Various non-profits provide grants to support specific causes like women-owned businesses or green initiatives.

- Research and Development Grants: These are for startups involved in innovative projects or scientific research.

Besides these, there are also sector-specific grants. For instance, agriculture startups can find grants tailored to their needs. Similarly, tech startups might look for innovation-focused grants.

| Grant Type | Provider | Eligibility |

|---|---|---|

| Government Grants | Federal/State Governments | Varies by program |

| Corporate Grants | Large Corporations | Industry-specific |

| Non-Profit Grants | Non-Profit Organizations | Cause-specific |

| R&D Grants | Research Institutions | Innovation-based |

Each grant type has different requirements. Researching them thoroughly ensures you apply for the most suitable ones. Leveraging these grants can significantly aid in your startup funding journey.

Application Process

Applying for grants can be competitive. Here are steps to ensure a successful application:

- Research: Identify grants that match your business type and goals. Use resources like the SBA website, grant databases, and industry networks.

- Prepare Documents: Most grants require a detailed business plan, financial statements, and project proposals. Ensure these documents are up-to-date and accurate.

- Write a Strong Proposal: Your proposal should clearly explain your business idea, how the grant funds will be used, and the expected outcomes. Highlight any unique aspects of your business.

- Submit Application: Follow the instructions carefully. Missing information or errors can lead to disqualification.

- Follow Up: After submission, keep track of deadlines and any additional requirements. Stay in contact with the grant provider for updates.

In addition to grants, explore other business financing options. Crowdfunding for businesses, microloans for startups, and no-collateral loans are viable alternatives. SBA loans and alternative lending can also provide needed funds. With patience and persistence, securing financial assistance for entrepreneurs is possible.

Remember, a well-prepared application increases your chances of success. Keep your business credit score in check and always be ready with your documents. This preparation will pay off in the long run.

Networking Strategies

Starting a business with no money can be tough, but networking can help you get a startup business loan. Networking strategies can connect you with potential investors and mentors. These connections can help you understand business loan requirements and explore alternative financing options. Let’s dive into some effective networking strategies.

Building Connections

Building connections is essential in networking for entrepreneurs. Strong relationships can lead to valuable advice, referrals, and funding opportunities. Here are some ways to build connections:

- Attend industry events: Industry events are great places to meet potential investors. Attend conferences, trade shows, and seminars.

- Join local business groups: Local business groups and chambers of commerce often have networking events. These events can help you meet other entrepreneurs and investors.

- Use online platforms: Websites like LinkedIn can help you connect with professionals in your industry. Reach out to people who might be interested in your startup.

Here is a quick table summarizing these points:

| Method | Description |

|---|---|

| Attend Industry Events | Meet potential investors at conferences, trade shows, and seminars. |

| Join Local Business Groups | Network with other entrepreneurs and investors at local events. |

| Use Online Platforms | Connect with professionals in your industry through websites like LinkedIn. |

Building these connections can help you find small business grants and other startup funding options. It can also provide insights into financial assistance for startups and no collateral loans.

Leveraging Social Media

Social media is a powerful tool for networking. It helps you connect with investors, mentors, and other entrepreneurs. Here are some tips for leveraging social media:

- Create a professional profile: Ensure your profile on LinkedIn, Twitter, and Facebook is professional. Highlight your startup and your achievements.

- Join relevant groups: Many social media platforms have groups for entrepreneurs. Join these groups to share ideas and find potential investors.

- Engage with your audience: Regularly post updates about your startup. Share successes and challenges. Engage with comments and messages.

Consider the following steps:

- Identify your target audience.

- Post valuable content regularly.

- Engage with followers and respond to comments.

- Reach out to potential investors through direct messages.

Leveraging social media can help you understand business loan requirements and connect with people who can provide crowdfunding for startups. It’s also a great way to boost your personal credit score by showing responsible financial behavior. Use social media to explore alternative financing options and find the best fit for your startup.

Preparing For Lender Meetings

Securing a startup business loan with no money can seem like a daunting task. A critical step in this process is preparing for lender meetings. These meetings are your chance to make a strong impression and prove that your business idea is worth the investment. Preparation is key to ensuring success. Here are some essential elements to consider.

Essential Documents

Being well-prepared with essential documents is crucial for a successful lender meeting. Documents provide evidence of your business’s potential and your preparedness as an entrepreneur. Here are some key documents you should bring:

- Business Plan: A detailed business plan presentation shows your business strategy, market analysis, and financial projections.

- Credit Report: Lenders will check your credit score. Bring a recent credit report to discuss any potential issues.

- Financial Statements: Include personal and business financial statements, showcasing your financial health and projections.

- Tax Returns: Provide personal and business tax returns for the past two to three years.

- Legal Documents: Include business licenses, articles of incorporation, and any contracts or leases.

Having these documents organized and ready will make a strong impression. It shows that you are serious about your startup funding and have done your homework. Below is a table summarizing the essential documents:

| Document | Description |

|---|---|

| Business Plan | Detailed strategy and financial projections |

| Credit Report | Recent credit score and history |

| Financial Statements | Personal and business financial health |

| Tax Returns | Personal and business tax history |

| Legal Documents | Business licenses and contracts |

Presentation Tips

Delivering a compelling presentation can significantly impact your business loan approval. Here are some tips to ensure your presentation stands out:

- Know Your Audience: Research the lender’s background. Understand their criteria and preferences for small business financing.

- Be Clear and Concise: Present your ideas clearly. Avoid jargon and ensure your points are easy to understand.

- Highlight Key Points: Focus on the most critical aspects of your business plan presentation. Emphasize your unique selling points and how you plan to achieve your goals.

- Practice Your Pitch: Rehearse your presentation multiple times. This will help you stay confident and smooth during the actual meeting.

- Prepare for Questions: Anticipate questions the lender might ask. Have well-thought-out answers ready, especially about alternative financing options and unsecured business loans.

Remember, your goal is to convince the lender of your business’s potential. Show confidence, passion, and a deep understanding of your business. Below is a table summarizing the key presentation tips:

| Tip | Description |

|---|---|

| Know Your Audience | Research lender’s background and criteria |

| Be Clear and Concise | Avoid jargon, ensure clarity |

| Highlight Key Points | Emphasize unique selling points |

| Practice Your Pitch | Rehearse multiple times |

| Prepare for Questions | Anticipate and prepare answers |

By following these tips, you can improve your chances of securing the startup funding you need.

Credit: finimpact.com

Frequently Asked Questions

Can You Get A Business Loan Without Money?

Yes, you can get a business loan without money. Lenders may consider factors like credit score, business plan, and collateral.

Can A New Llc Get A Loan?

Yes, a new LLC can get a loan. Lenders may require a strong business plan, good credit, and collateral. Financial documentation and personal guarantees can also improve chances.

Can An Llc Get A Loan With No Credit?

Yes, an LLC can get a loan with no credit. Lenders may consider business plans, cash flow, and collateral.

What Is The Easiest Business Loan To Get For Startups?

The easiest business loan for startups is a microloan. These loans are typically easier to obtain and have flexible requirements. They are ideal for new businesses needing small amounts of capital.

Conclusion

Getting a startup business loan with no money is challenging but possible. Research your options carefully. Explore grants and microloans. Consider crowdfunding platforms. Build a strong business plan. Seek advice from mentors. Network with like-minded entrepreneurs. Stay persistent. With determination and the right strategy, you can secure the funding you need.

Remember, every successful entrepreneur started somewhere. Your journey begins now.